How to Open a Forex Trading Account: A Comprehensive Guide

Entering the world of forex trading can be both exhilarating and daunting for newcomers. One of the fundamental steps to kickstart your trading journey is to open forex trading account Trading Brokers in Pakistan. In this article, we will walk you through the necessary steps, considerations, and tips for successfully opening your Forex trading account.

Understanding Forex Trading

Forex, or foreign exchange, trading involves the buying and selling of national currencies against one another. Traders engage in this decentralized global market with the aim of profiting from fluctuations in currency values. It’s crucial to understand that trading carries inherent risks, but with the right tools and knowledge, potential rewards can be substantial.

Choosing a Forex Broker

The first step to opening a Forex trading account is selecting a reliable Forex broker. A broker acts as an intermediary between you and the market, providing access to trading platforms and various tools. Here are critical factors to evaluate when choosing a broker:

- Regulation: Ensure the broker is regulated by a recognized authority (e.g., FCA, SEC). This ensures a level of safety for your funds.

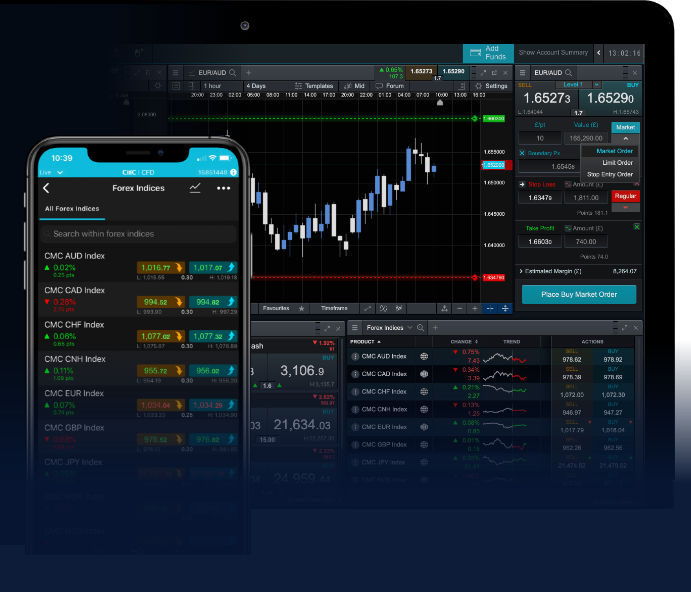

- Trading Platform: The trading platform should be user-friendly and equipped with necessary tools for analysis.

- Account Types: Brokers offer various types of accounts depending on the level of your trading experience and the capital you wish to invest.

- Spreads and Commissions: Understand the costs of trading, including spreads and commissions. Lower fees can significantly affect your profitability.

- Customer Support: Reliable customer service is essential, especially for new traders who might face challenges while trading.

Required Documentation

Once you have chosen a broker, you will need to provide certain documentation to open your Forex account. These documents typically include:

- Proof of Identity: This can include a passport, national ID, or driver’s license.

- Proof of Address: You may need to submit a recent utility bill or bank statement showing your name and address.

- Financial Information: Some brokers might require financial information to comply with regulatory standards.

Opening a Forex Trading Account

Here’s a step-by-step guide to opening your Forex trading account:

- Visit the Broker’s Website: Navigate to the broker’s website and find the option to open a new account.

- Fill Out the Application Form: Complete the application form with your personal details, including your financial information.

- Submit Required Documents: Upload or submit copies of your identity and address verification documents.

- Account Verification: Wait for the broker to verify your details. This process can take anywhere from a few minutes to several days.

- Fund Your Account: Once approved, you can fund your trading account through various payment methods like bank transfer, credit card, or e-wallets.

- Start Trading: After funding your account, download the trading platform, log in, and start trading.

Choosing the Right Trading Account Type

When opening a Forex trading account, you might encounter different types of accounts. Here are some common types:

- Standard Account: Ideal for experienced traders, allowing for larger trade sizes and access to features.

- Mini Account: Suitable for beginners, requiring lower initial deposits and smaller trade sizes.

- Managed Account: A service where professional traders handle your investments on your behalf.

Understanding Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of capital. For example, a broker may offer a leverage ratio of 100:1, enabling you to trade $100,000 with just $1,000. However, while leverage can amplify profits, it also increases potential losses. It’s vital to use leverage wisely and understand margin requirements set by your broker.

Practicing with a Demo Account

Before diving into real money trading, consider practicing with a demo account. Most brokers offer demo accounts providing virtual money to trade, allowing you to hone your skills without financial risk. Utilize this opportunity to familiarize yourself with the trading platform, develop strategies, and understand market movements.

The Importance of Trading Education

While opening a Forex trading account is the first step, continuous education is crucial for long-term success. Enroll in online courses, attend webinars, read trader guides, and follow market news. Knowledge will empower you to make informed decisions and improve your trading strategies.

Conclusion

Opening a Forex trading account is an essential milestone in your trading journey. By doing your research, choosing a reputable broker, and understanding the ins and outs of trading, you’ll be better equipped to navigate the Forex market. Remember to practice risk management, stay disciplined, and continuously enhance your trading knowledge to enjoy a successful trading experience.