In the fast-paced world of Forex trading, staying informed about the latest news and trends is crucial for success. Today’s Forex trading news provides essential insights that can influence currency markets globally. For traders looking to gain an edge in the market, it’s important to keep abreast of fluctuations and economic indicators. For more information on investment opportunities, visit forex trading news today Trading Broker UAE.

Current Market Trends

As we dive into today’s Forex trading news, several trends are emerging that traders should be aware of. The Forex market is influenced by a variety of factors including economic data releases, geopolitical events, and central bank policies. Currently, the USD is experiencing fluctuations due to mixed economic data from the United States. While some analysts predict a strengthening of the dollar, others remain cautious, citing potential economic slowdowns.

Economic Data Releases

Today’s Forex trading landscape is heavily shaped by key economic indicators. Recent releases from the U.S. Bureau of Labor Statistics show a slight increase in unemployment claims, prompting traders to reassess their positions on the dollar. Meanwhile, the Eurozone has reported better-than-expected manufacturing data, leading to a strengthening of the Euro against major currencies.

On the Asian front, China’s economic data continues to show signs of recovery, with manufacturing increasing more than anticipated. This improvement is bolstering the Chinese Yuan, as traders look for opportunities in the emerging markets. The relationship between the U.S. and China remains a significant driver of global Forex movements, making it imperative for traders to keep an eye on these developments.

Geopolitical Events Impacting Forex

Geopolitical events often create volatility in Forex trading, and today’s situation is no exception. Ongoing tensions in various regions are affecting trader sentiment. For example, developments concerning Brexit negotiations are causing uncertainty in the GBP market, leading to fluctuations in currency pairs involving the British Pound. Traders who can anticipate these moves will be better positioned to capitalize on the volatility.

Central Bank Policies

Central bank announcements are pivotal in shaping currency values. Recent meetings and statements from the Federal Reserve, the European Central Bank, and other central banks are key focal points for Forex traders. In today’s news, the Fed’s guidance on interest rates continues to steer the USD’s trajectory, and any changes to monetary policy are likely to result in significant market movements.

Analysts are closely monitoring indications of future rate hikes or cuts, as these decisions play a vital role in currency valuation. Forex traders are advised to stay updated on minutes from central bank meetings, as these can provide hints about upcoming economic policy changes that might influence trading decisions.

Technical Analysis in Forex Trading

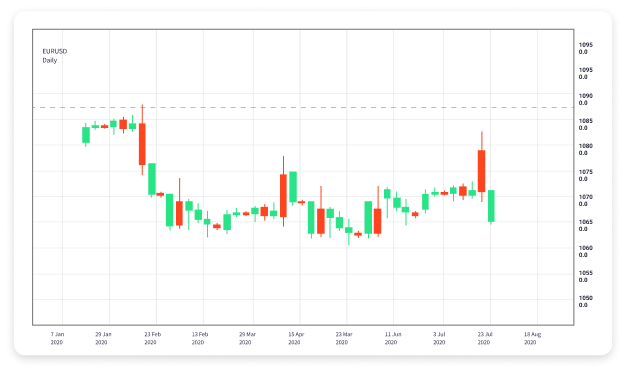

In addition to analyzing news and economic data, traders are also employing technical analysis to make informed decisions. Chart patterns and technical indicators can signal potential entry and exit points for trades. Today’s Forex trading news includes various analysts sharing their technical insights, offering traders valuable tools to enhance their strategies.

Traders are particularly focused on support and resistance levels in major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Recognizing these levels can help traders establish risk management strategies and optimize their trading positions.

Expert Opinions and Forecasts

Finally, turning to expert opinions can provide traders with a broader perspective on market conditions. Various financial analysts are weighing in on today’s Forex news, offering forecasts that can help guide trading decisions. Whether traders are positioning for the short term or looking at longer-term trends, expert insights can be instrumental.

For instance, some analysts are predicting a bullish trend for the Euro following the positive economic reports, while others caution about potential corrections due to overarching uncertainties in global markets. These insights, combined with data and charts, can aid traders in making calculated decisions.

Conclusion

In conclusion, today’s Forex trading news highlights the dynamic nature of the market. With economic indicators, geopolitical events, and central bank policies all playing crucial roles, traders are urged to remain vigilant. By integrating real-time news with technical analysis and expert insights, traders can position themselves advantageously in the constantly evolving Forex landscape.

For those interested in maximizing their trading potential, remember to leverage technology and analytics to stay updated, and consider professional guidance to navigate the complexities of Forex trading successfully.